Investing in Celebrities

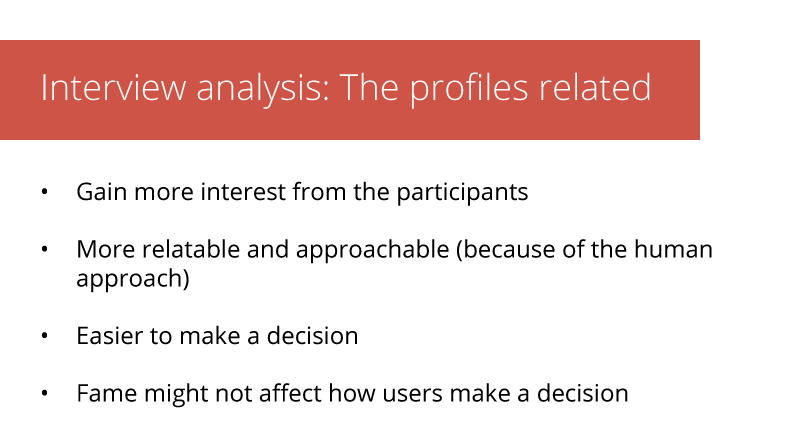

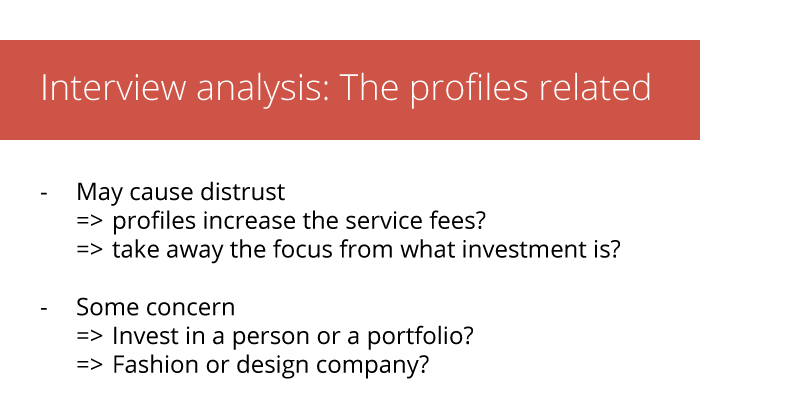

A master’s thesis studies the use of profiles as representations of investment securities in Walter website. Walter is a website that provides a solution for long-term investment in Sweden by using profiles of famous people. Each profile as an investor has their own portfolio that invests in different investment securities (such as stocks and funds). Having these features, Walter service is of different way of thinking and investing. Therefore, this thesis aims to investigate the concept of Walter, especially the use of the profiles to see if they can affect the decision making process of the users when making long-term investment. User experience and usability of Walter are also taken into account.

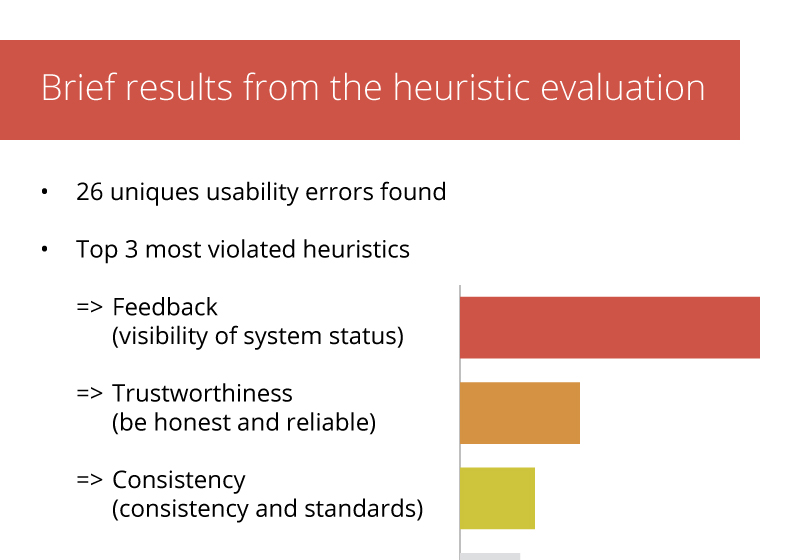

This thesis was my degree project for my master’s study in Human-Computer Interaction program at KTH. This work was a collaboration with Great Works starting from February until May 2017. I was in charge of the whole study including planning the tests, recruiting, conducting, and analysing the results. The methods used in this study were heuristic evaluation, user testing with think aloud protocol, and interview.

Please note that all data and images of Walter used on this page were made up for testing and taken during the development process (in April-May 2017). They may look different in the current version of the website.

Read full report here: KTH DiVA

Supervisor

Jarmo Laaksolahti, School of Computer Science and Communication (CSC), Media Technology and Interaction Design, MID, KTH

Principal

Eva Sjökvist (product owner), Great Works

Disciplines

- User Research

- User Testing

- Heuristic Evaluation

- Interview